Petroleum stands as one of the crucial resources in today's global industry, serving as a foundation of modern civilization. Not only is it a primary source of energy for transportation, but it also plays an crucial role in the manufacturing sector, powering critical entities such as rocket engines and electricity generation plants.

Nevertheless, recognizing that petroleum is not an infinite sources of energy. Its production demands a substantial amount of time and a complex process. Therefore, governments must take a two-fold approach: safeguarding this precious resource while simultaneously ensuring its sustainable production. To achieve this balance, creating a management system that facilitates collaboration between the government and third-party is needed. There are three manage system that we used

Nevertheless, recognizing that petroleum is not an infinite sources of energy. Its production demands a substantial amount of time and a complex process. Therefore, governments must take a two-fold approach: safeguarding this precious resource while simultaneously ensuring its sustainable production. To achieve this balance, creating a management system that facilitates collaboration between the government and third-party is needed. There are three manage system that we used

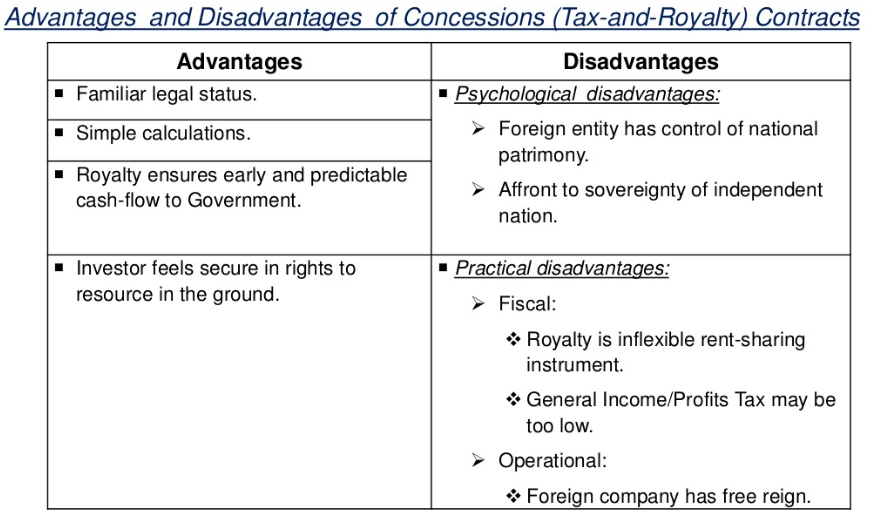

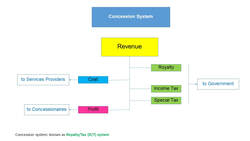

Concession System : A grant extended by a government to permit a company to explore for and produce oil, gas or mineral resources within a strictly defined geographic area, typically beneath government-owned lands or lands in which the government owns the rights to produce oil, gas or minerals. The grant is usually awarded to a company in consideration for some type of bonus or license fee and royalty or production sharing provided to the host government for a specified period of time.

Contract Period(years)

-Exploration

3+3(with in 3 years extendable)

-Production

20(with 10 years extendable) start immediately after the end of the exploration period

Contract Area

-Exploration Block

As defined in the bid announcement,each concessionaire can hold up to 5 exploration blocks with a total area of not exceeding 20,000 square kilometers.Area relinquishment is 50% at the end of year 4 and another 25% at the end of year 6

-Production Area

With commercial discovery,the production area will be delineated and production can start right away even in the exploration period.

-Reserved Area

In the case the production area is declared,12.5% of the original exploration area can be reserved for further exploration for another period of 5 years after the end of the exploration period.

Royalty

- Depends on oil production

-Exploration

3+3(with in 3 years extendable)

-Production

20(with 10 years extendable) start immediately after the end of the exploration period

Contract Area

-Exploration Block

As defined in the bid announcement,each concessionaire can hold up to 5 exploration blocks with a total area of not exceeding 20,000 square kilometers.Area relinquishment is 50% at the end of year 4 and another 25% at the end of year 6

-Production Area

With commercial discovery,the production area will be delineated and production can start right away even in the exploration period.

-Reserved Area

In the case the production area is declared,12.5% of the original exploration area can be reserved for further exploration for another period of 5 years after the end of the exploration period.

Royalty

- Depends on oil production

Petroleum Income Tax

- Special Remuneratory Benefit (SRB) is designed to work as windfall profit tax which will only imposed if ;

-All capital cost(plus special reduction) are recovered and Annual revenue becomes drastically high compared with the investment

Incentives

-Exemption of any other corporate taxes, duties and taxed on imported equipment and materials

- Special Remuneratory Benefit (SRB) is designed to work as windfall profit tax which will only imposed if ;

-All capital cost(plus special reduction) are recovered and Annual revenue becomes drastically high compared with the investment

Incentives

-Exemption of any other corporate taxes, duties and taxed on imported equipment and materials

Petroleum Income Tax

- Special Remuneratory Benefit (SRB) is designed to work as windfall profit tax which will only imposed if ;

-All capital cost(plus special reduction) are recovered and Annual revenue becomes drastically high compared with the investment

Incentives

-Exemption of any other corporate taxes, duties and taxed on imported equipment and materials

- Special Remuneratory Benefit (SRB) is designed to work as windfall profit tax which will only imposed if ;

-All capital cost(plus special reduction) are recovered and Annual revenue becomes drastically high compared with the investment

Incentives

-Exemption of any other corporate taxes, duties and taxed on imported equipment and materials

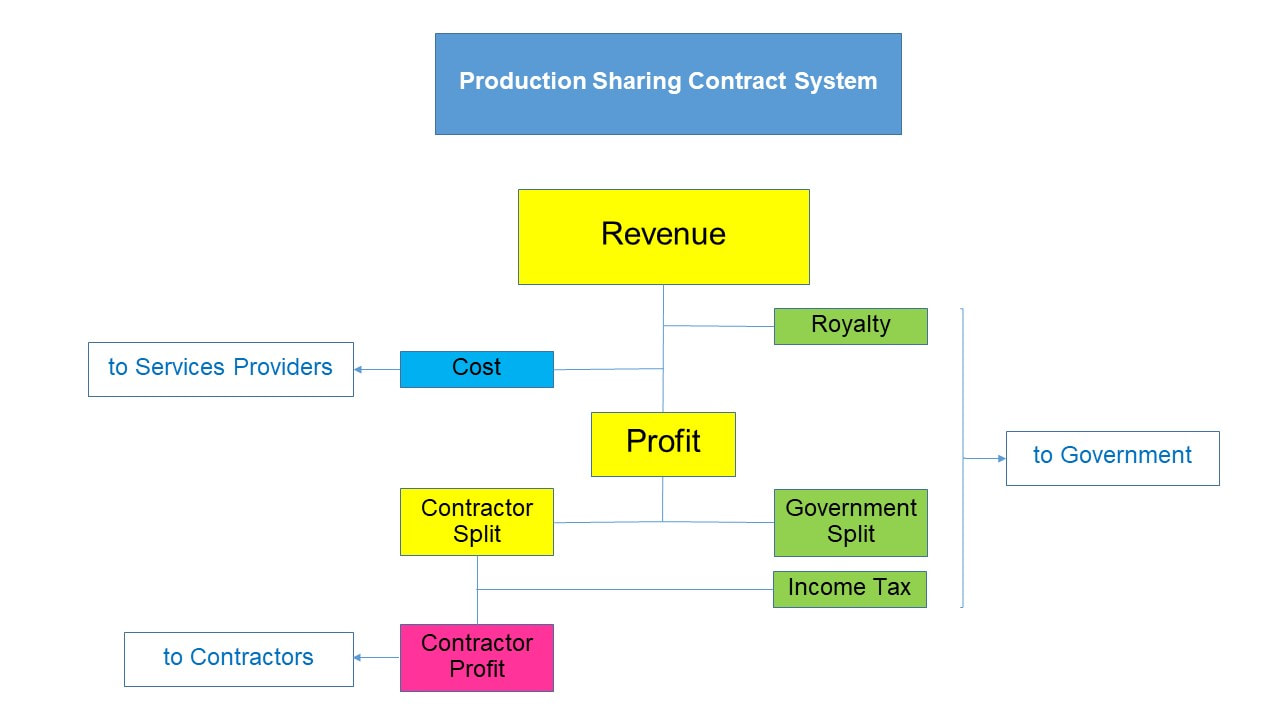

Production Sharing Contract System : An agreement between the parties to a well and a host country regarding the percentage of production each party will receive after the participating parties have recovered a specified amount of costs and expenses.

- PSCs are ubiquitous in much of Asia, Africa and the Middle East, with only a handful of countries in these regions adopting a Royalty/Tax or concession (RT) regime or some hybrid.

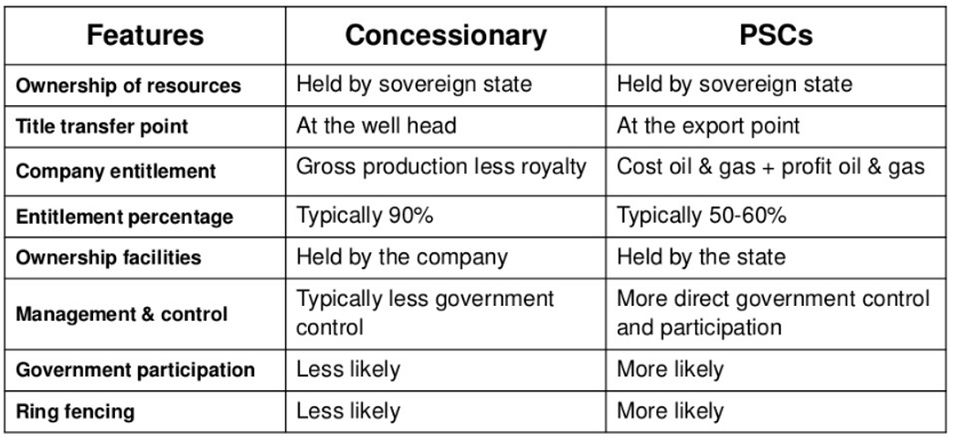

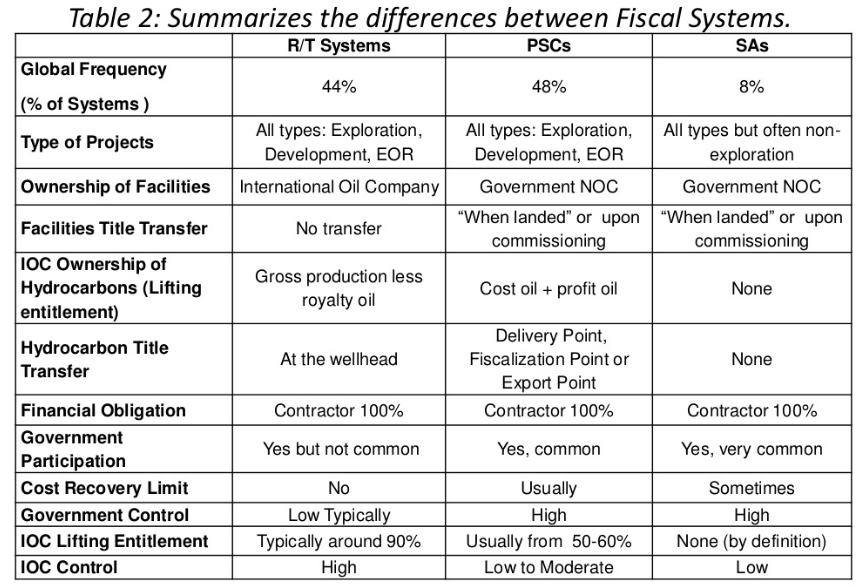

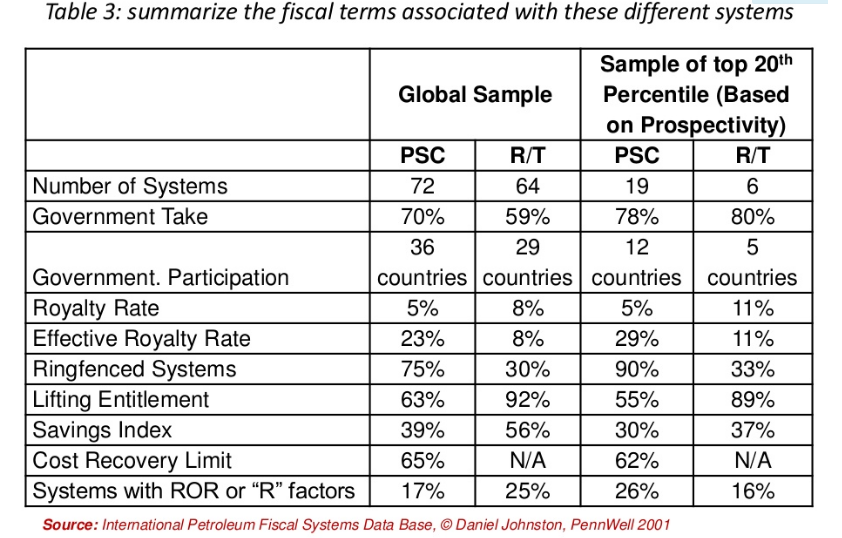

- The fundamental distinction between PSC and RT regimes lies in the ownership of the resource.

- The resource is owned by the State and profit is shared with the investor after reimbursement of costs. The investor, therefore, functions as a Contractor. PSCs also tend to be more regulated by the State.

- There is a prevalence of NOCs in countries operating under a PSC regime.

- There is a balance of risk between the private investor and the State with the foundation being for the State to take as much as possible of the economic rent, while still maintaining attractiveness for investors.

- Such a balance is very delicate and some countries have performed this more successfully than others.

- An investor will be more willing to tolerate harsh terms if the returns are perceived to be worth the effort.

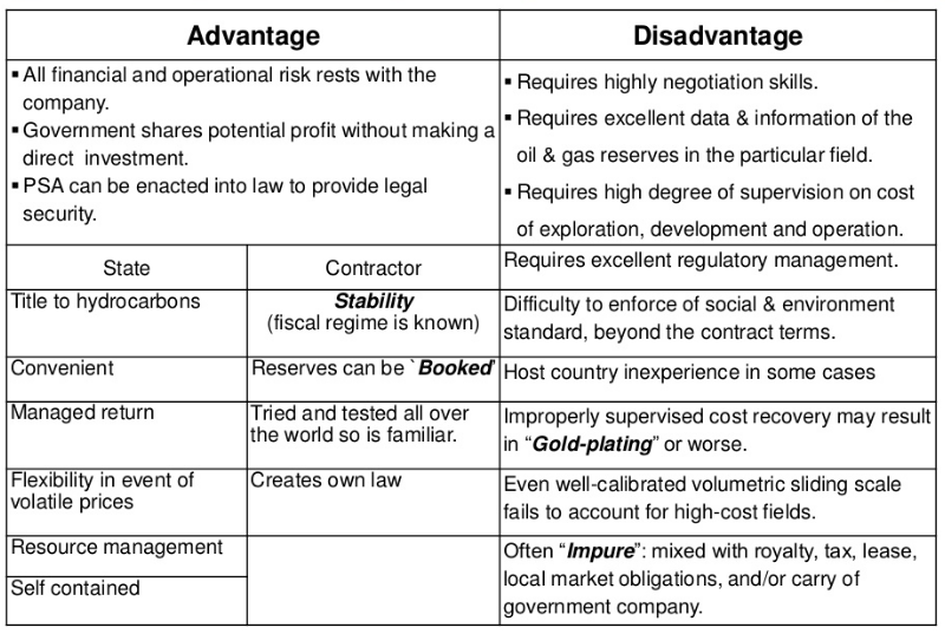

PSC Advantage & Disadvantage for Host Governments/Host Countries (HG)

Main Difference Concessionary & Production Sharing Contracts (PSCs)

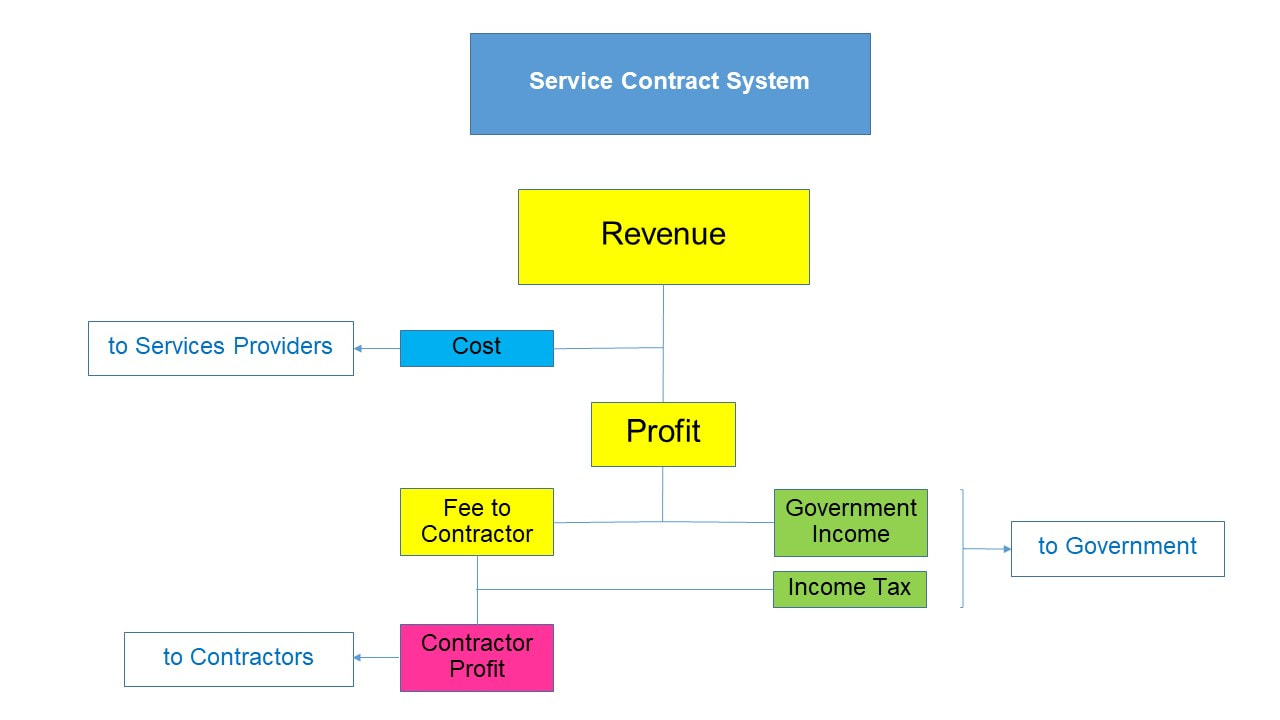

Service Contract System :

-The contractor is paid a cash fee for performing the service of producing petroleum.

-All production belongs to the state.

-The contractor is responsible for providing all capital associated with exploration and development. In return, if exploration efforts are successful, the contractor recovers costs through the sale of oil or gas plus a fee, The fee is often taxable.

Thailand Petroleum Fiscal Regimes

Currently, Thailand has two major fiscal systems for benefits allocations and obligations between the government and oil companies. They are the concession system and the production sharing contract system which are assigned to each petroleum field on respective conditions, predominantly subjected to petroleum law at the time of contract and the profitability of the field. The service contract system in Thailand is not implemented in substantial fields if not none. Different systems discussed in this article have been usually subjected to heated debates among politicians, economists, academics, and public members, for petroleum is the crucial revenue of Thailand as the national oil company PTT has generated government revenue substantially for decades. Among several debated topics, the best fiscal system question has not yet met its final answer. However, some research and government guidelines have been published to enact more efficient management. This section explains and illustrates the processes of the petroleum fiscal systems implemented in Thailand from 1971 to the present and the conditions for deploying each system.

At the beginning of the Thai petroleum industry, the concession system was enforced. The first concession model, the Thailand I Regime, was implemented from 1971 to 1981. This regime conditioned oil companies to pay 12.5% of petroleum sales to the government instantly as royalty and 50% of gross profit as income tax. Then the companies can take the rest money as profit, or loss. The study by Sirasoontorn and Suksai stated that the government’s take was around 60% of petroleum sales, and if oil companies could reduce cost, they could earn more profit while the government’s take was reduced. In other words, the government earned less revenue when the oil companies operated efficiently, resulting in the lack of government motives to support oil companies for more effective operations. Moreover, as this regime fixed the royalty rate to 12.5% regardless of oil companies’ production, it would discourage investment in wildcat areas, resulting in an unattractive system for oil companies. Therefore, this regime was replaced after its usage for a decade.

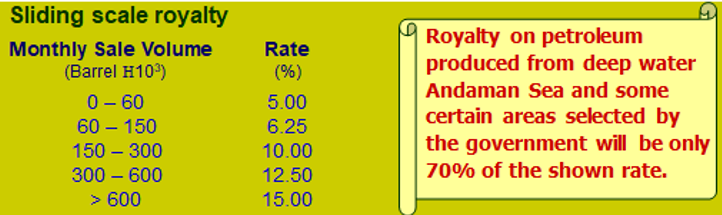

The next important regime was the Thailand III Regime, which started in 1989 to the present, although the Thailand II Regime was implemented before. This regime was more flexible and could generate more revenue for the government. The major improvement from the Thailand I Regime was that it introduced a sliding scale rate of royalty from 5 to 15% from petroleum sales, instead of the fixed rate of 12.5%. A new part of the government’s take was introduced - Special Remuneration Benefit. SRB is an extra government benefit when oil companies produce petroleum more than expected and is calculated depending on production, pricing, and difficulties of operations. The 50% income tax is still unchanged. The Department of Mineral Fuels confirmed that the government’s take on this regime is more than that of the Thailand I Regime. The same study stated that oil companies could earn more when operating more efficiently. However, although oil companies pay less royalty when the production rate is low, they earn less profit when they produce too much as the royalty rate increases to become a huge cost. This is problematic since it discourages oil companies from producing at a high rate. Oil companies could limit their production rate or transfer production rights to others to control their profit at the maximum.

Thai petroleum fiscal systems are not limited to the concession system. Another system implemented in Thailand is the production sharing contract system or PSC. The process of this system can be simplified into sharing petroleum profit among stakeholders by the predetermined ratio. The development of this system is also supported by the desire for more government’s take and control over national resource management and operations as those in several other countries, and the thoughts that the government taking more risks should earn more return. Moreover, this system could be a solution to difficult problems such as operations in some areas or conditions. Currently, this system is implemented in overlapping territorial claims areas of Thailand and Malaysia (MTJDA). The profit from operations at MTJDA is divided equally between Thailand and Malaysia. Besides that, the PSC system is now being implemented in the Gulf of Thailand when oil companies PTTEP and Chevron acquired rights to explore and produce petroleum in new blocks recently.

All aforementioned systems cannot be implemented in any area without proper consideration. For example, although the PSC system could probably generate more government’s take, it should not be used in every petroleum field. Similarly, the concession system might attract oil companies to invest, but the implementation of it in some areas would not maximize the nation’s benefit. Even the service contract system is encouraged to be implemented in some conditions. The major factors determining which system would be used in considered petroleum fields are the economical and geological properties of the fields. Generally, governments worldwide attempt to protect their nation’s benefit the best they can by setting conditions that give the highest government’s take. Simultaneously, the conditions must be attractive enough to receive oil companies’ interest, and competition among them would increase the government’s take in both short- and long-term. Therefore, balancing the nation’s benefits and attractive conditions must be carefully conducted by governments.

The Thai Petroleum Committee published information about the chance to discover economical petroleum reserves in areas across Thailand and the fiscal system recommended in each area. On average, drilling exploration wells across Thailand yields 39% economic well. The announcement stated that in areas where the chance to yield economic wells is greater than 39% the PSC system is implemented. The Gulf of Thailand is the only area that is suitable for the PSC system, with a 50% chance. In the areas where the chance is less than 39% the concession system is used. Interestingly, the Andaman Sea has an absolute 0% chance of discovering economic reserves. Moreover, the announcement clearly stated that in the area of high petroleum reserves, the service contract system would be implemented, though such areas are not found yet.

In conclusion, governments worldwide have developed petroleum fiscal systems to protect their national resources at their best while at the same time incentivizing investment from oil companies by setting proper, careful, and detailed conditions for exploration and production businesses. There are three main systems used nowadays which are the concession system, the production sharing contract system (PSC), and the service contract system. In the concession system, oil companies pay royalties, taxes, SRB, and other benefits to the government at predetermined rates. In the PSC system, oil companies collaborate with the government to operate, take risks, and earn profits or losses together at the ratios in accordance with the contracts. In the service contract system, the government is the owner of petroleum areas and hires oil companies to produce, taking the whole risks and earning the whole business profits. In Thailand, all three systems are acknowledged, but the service contract system is not yet implemented due to the condition in the petroleum committee announcement which clearly states in which condition each system would be implemented to protect the nation’s benefit and attract sustainable investments. In areas where the chance to find economic reserves is greater than the average value of 39%, the PSC system is used, the concession system in areas of lesser chance, and the service contract system is implemented in areas of high petroleum reserves which are the hope for the prosperity of our oil and gas industry and our beloved nation.

At the beginning of the Thai petroleum industry, the concession system was enforced. The first concession model, the Thailand I Regime, was implemented from 1971 to 1981. This regime conditioned oil companies to pay 12.5% of petroleum sales to the government instantly as royalty and 50% of gross profit as income tax. Then the companies can take the rest money as profit, or loss. The study by Sirasoontorn and Suksai stated that the government’s take was around 60% of petroleum sales, and if oil companies could reduce cost, they could earn more profit while the government’s take was reduced. In other words, the government earned less revenue when the oil companies operated efficiently, resulting in the lack of government motives to support oil companies for more effective operations. Moreover, as this regime fixed the royalty rate to 12.5% regardless of oil companies’ production, it would discourage investment in wildcat areas, resulting in an unattractive system for oil companies. Therefore, this regime was replaced after its usage for a decade.

The next important regime was the Thailand III Regime, which started in 1989 to the present, although the Thailand II Regime was implemented before. This regime was more flexible and could generate more revenue for the government. The major improvement from the Thailand I Regime was that it introduced a sliding scale rate of royalty from 5 to 15% from petroleum sales, instead of the fixed rate of 12.5%. A new part of the government’s take was introduced - Special Remuneration Benefit. SRB is an extra government benefit when oil companies produce petroleum more than expected and is calculated depending on production, pricing, and difficulties of operations. The 50% income tax is still unchanged. The Department of Mineral Fuels confirmed that the government’s take on this regime is more than that of the Thailand I Regime. The same study stated that oil companies could earn more when operating more efficiently. However, although oil companies pay less royalty when the production rate is low, they earn less profit when they produce too much as the royalty rate increases to become a huge cost. This is problematic since it discourages oil companies from producing at a high rate. Oil companies could limit their production rate or transfer production rights to others to control their profit at the maximum.

Thai petroleum fiscal systems are not limited to the concession system. Another system implemented in Thailand is the production sharing contract system or PSC. The process of this system can be simplified into sharing petroleum profit among stakeholders by the predetermined ratio. The development of this system is also supported by the desire for more government’s take and control over national resource management and operations as those in several other countries, and the thoughts that the government taking more risks should earn more return. Moreover, this system could be a solution to difficult problems such as operations in some areas or conditions. Currently, this system is implemented in overlapping territorial claims areas of Thailand and Malaysia (MTJDA). The profit from operations at MTJDA is divided equally between Thailand and Malaysia. Besides that, the PSC system is now being implemented in the Gulf of Thailand when oil companies PTTEP and Chevron acquired rights to explore and produce petroleum in new blocks recently.

All aforementioned systems cannot be implemented in any area without proper consideration. For example, although the PSC system could probably generate more government’s take, it should not be used in every petroleum field. Similarly, the concession system might attract oil companies to invest, but the implementation of it in some areas would not maximize the nation’s benefit. Even the service contract system is encouraged to be implemented in some conditions. The major factors determining which system would be used in considered petroleum fields are the economical and geological properties of the fields. Generally, governments worldwide attempt to protect their nation’s benefit the best they can by setting conditions that give the highest government’s take. Simultaneously, the conditions must be attractive enough to receive oil companies’ interest, and competition among them would increase the government’s take in both short- and long-term. Therefore, balancing the nation’s benefits and attractive conditions must be carefully conducted by governments.

The Thai Petroleum Committee published information about the chance to discover economical petroleum reserves in areas across Thailand and the fiscal system recommended in each area. On average, drilling exploration wells across Thailand yields 39% economic well. The announcement stated that in areas where the chance to yield economic wells is greater than 39% the PSC system is implemented. The Gulf of Thailand is the only area that is suitable for the PSC system, with a 50% chance. In the areas where the chance is less than 39% the concession system is used. Interestingly, the Andaman Sea has an absolute 0% chance of discovering economic reserves. Moreover, the announcement clearly stated that in the area of high petroleum reserves, the service contract system would be implemented, though such areas are not found yet.

In conclusion, governments worldwide have developed petroleum fiscal systems to protect their national resources at their best while at the same time incentivizing investment from oil companies by setting proper, careful, and detailed conditions for exploration and production businesses. There are three main systems used nowadays which are the concession system, the production sharing contract system (PSC), and the service contract system. In the concession system, oil companies pay royalties, taxes, SRB, and other benefits to the government at predetermined rates. In the PSC system, oil companies collaborate with the government to operate, take risks, and earn profits or losses together at the ratios in accordance with the contracts. In the service contract system, the government is the owner of petroleum areas and hires oil companies to produce, taking the whole risks and earning the whole business profits. In Thailand, all three systems are acknowledged, but the service contract system is not yet implemented due to the condition in the petroleum committee announcement which clearly states in which condition each system would be implemented to protect the nation’s benefit and attract sustainable investments. In areas where the chance to find economic reserves is greater than the average value of 39%, the PSC system is used, the concession system in areas of lesser chance, and the service contract system is implemented in areas of high petroleum reserves which are the hope for the prosperity of our oil and gas industry and our beloved nation.

References:

- Asst. Prof. Kittiphong Jongkittinarukorn’s Fundamental of Petroleum Engineering lectures and materials

- Puree Sirasoontorn ([email protected]) and Napon Suksai ([email protected]), Applied Economics Journal, 2013

- The 2017 Petroleum Committee’s Announcement: https://dmf.go.th/public/list_upload/backend/list_5/files_20268_1.pdf